When anticipating a settlement, injured individuals and their families must strategically decide how and when the funds should be received. Even a multimillion-dollar settlement can be burned through with medical bills and unplanned spending. In this case study, we will examine how a sizable workers’ compensation settlement can be used to achieve a variety of goals.

Case Study: David

David, a 50-year-old ironworker and a primary income earner for his family of three, suffered a complete T12 spinal cord transection due to a steel beam striking him on a job site. Permanent paraplegia rendered him completely unable to return to his physically demanding job.

David’s wife became his primary caregiver, leaving their family’s financial future dependent on the workers’ compensation system. David netted $12 million when he settled his claim.

Through a combination of immediate funds and structured settlement annuities, a one-time settlement was transformed into a secure, adaptable financial foundation. Here is how a settlement plan was developed to achieve David’s immediate and long-term goals.

Goal #1: Ensuring Income Security

A $9 million structured settlement annuity was established to provide a steady income stream.

- Monthly Payments: David receives $32,248.20, payable monthly for life.

- Guaranteed Period: Payments are guaranteed1 for 25 years, providing income stability.

- Annual Growth: Payments increase at a rate of 2% compounded annually to combat inflation.

- Guaranteed Lump Sums:

- $100,000 paid at age 55

- $300,000 at age 60

- $500,00 at age 65

Goal #2: Comprehensive Medical Coverage

To address immediate and ongoing medical needs, the settlement plan incorporated upfront liquidity and a specialized Medicare Set-Aside structure.

- Initial Liquidity: David was given $2,170,070 upfront in cash placed into an advanced planning account. These funds cover immediate needs such as obtaining proper equipment and making adaptive modifications to his current home.

- Medicare Set-Aside: David applied for Social Security Disability, so a Workers’ Compensation Medicare Set-Aside (WCMSA) was crucial.

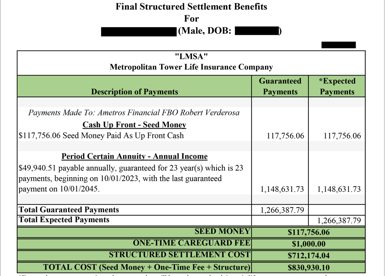

- Seed Deposit: $117,756.06

- Structured Medicare Set-Aside (MSA): A structured settlement was purchased using $712,174.04.

- This portion of the settlement will pay $49,940.51 into the MSA annually for 20 years and grow guaranteed tax-free to $1,266,387.79.

- Significant Savings: By structuring the MSA, rather than funding with a cash lump sum, David saved $436,457.69. The annual structured settlement stream allows Medicare to cover care if David’s funds are exhausted before the next scheduled structure distribution.

Goal #3: Fund Son’s College Tuition

Ensuring his son’s educational future was a key priority for David.

- 529 Plan Contribution: Part of his monthly payments will fund a 529 college savings plan. David’s son will then receive a semi-annual distribution of approximately $40,000 between the ages of 18-21. The 529 will provide tax-free income for college tuition, room and board, and other related expenses.

Goal #4: Estate Legacy Plan

- Guaranteed Payments for Beneficiaries: Monthly and lump sum payments are guaranteed, setting up his beneficiaries to receive tax-free payments upon David’s death.

- Long-Term Wealth Accumulation: The annuity can reach over $18 million in tax free payments, with guaranteed payments totaling $13 Million.

- Retirement Security: A significant sum of money will support David and his wife in retirement.

Overall, this plan provides absolute financial security, protection against financial mismanagement, aligns with long-term needs, has comprehensive care coverage, and most importantly provides David and his family peace of mind.

Contact Sage to Learn More

Sage collaborates closely with injured claimants and their families to create plans that improve their long-term quality of life. Contact us today for more information about the benefits of settling workers’ compensation claims with structured settlements.

1 Guarantees are subject to the claims-paying abilities of the issuing insurance company.