Accepting your contingency fees in cash requires you to report the full fee as taxable income. On the other hand, you could grow your pre-tax fees and spread the taxable income out over time. An attorney fee deferral does just that.

Plaintiff attorneys have two options for fee deferrals: market-based structured settlements and fixed annuities. The best choice depends on various factors, including your fee size, age, and risk profile. Many attorneys choose to combine fixed annuities and market-based structured settlements to maximize the benefits of both. Keep reading to learn more.

Market-Based Structured Settlements

Market-based structured settlements use investment portfolios to grow attorney fees. The funds are placed in an investment account with a financial advisor of your choice that utilizes a portfolio with a blend of stocks and bonds. The chosen portfolio is dependent on the desired level of risk.

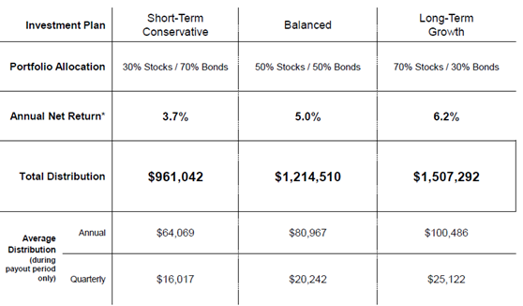

First, the account grows during a deferral period. Next, the funds are distributed during the payout period and will continue to be invested until fully distributed. Below is an illustration1 of the potential growth that could be achieved on a $500,000 attorney fee.

Starting Amount: $500,000

Deferral Period: 10 Years

Payout Period: 15 Years

The potential growth depends on the portfolio allocation and, of course, the stock market's performance. A market-based structured settlement allows you to participate in the market while leveraging the tax benefits of deferred payments.

Fixed Annuities

If you seek guaranteed2 income, a fixed annuity is the best option. Recent rates have been highly favorable, making now an ideal time to purchase a fixed annuity.

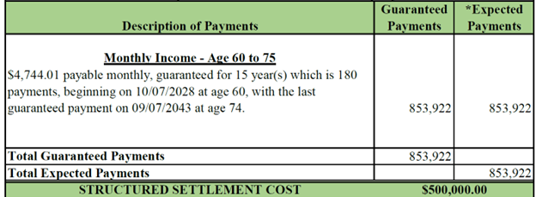

Below is a recent, real-life example of an attorney fee deferral using a fixed annuity.

Starting Amount: $500,000

Guaranteed Payments: $853,922

Payout Period: 15 Years

The fixed annuity payments have a 4.76% guaranteed internal rate of return. The money had time to grow pre-tax, and the guaranteed payments will be used to supplement income well into retirement.

Contact Sage for Attorney Fee Deferrals

Sage's experienced team and industry partners have helped attorneys nationwide create long-term plans for their attorney fees. Before you settle your next case, ask your Sage consultant about your fee deferral options.

Disclaimer: Neither Sage Settlement Consulting nor its affiliates are licensed to sell variable or securities products, nor do we provide legal, tax, accounting or investment advice. Please consult your legal or financial advisors for advice specific to your circumstances.

1 Note: Examples are given for illustrative purposes only. Hypothetical returns are calculated based on the historical 30-year performance of equity and bond index blended portfolios.

2 Guarantees are subject to the claims-paying abilities of the issuing insurance company.